Bad landlord: Kushner

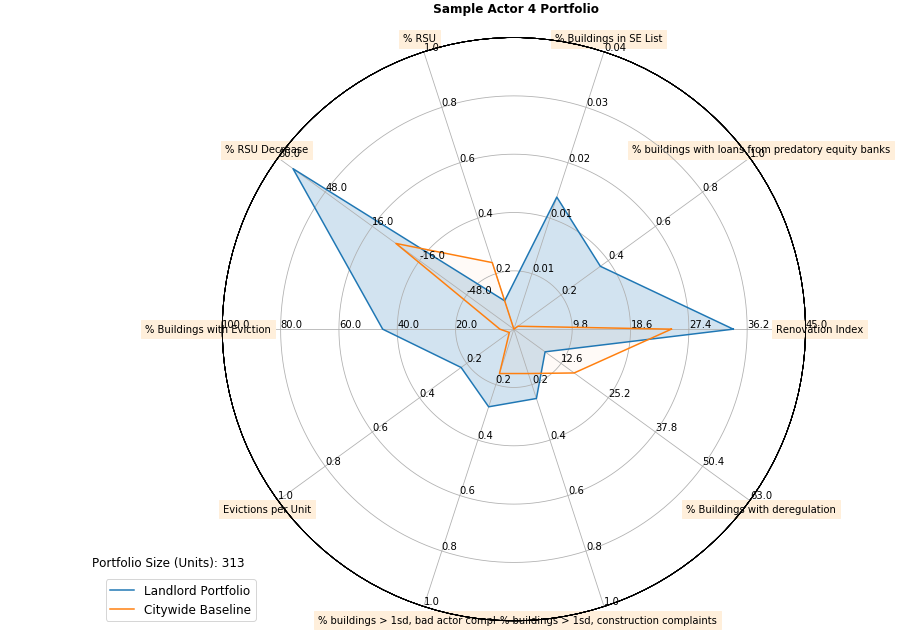

We tested our method for identifying predatory landlord behavior on several CUSP student’s portfolios, and found one landlord of concern (validated by news reports of tenant harassment). Here are some of the concerning facts:

Strong indications of predatory equity: around 40% of buildings received a loan from a bank identified by the Public Advocate as supporting predatory equity (city baseline: 2%)

Strong indications of predatory equity (part 2): this portfolio has one building on a list of properties advertised using coded language for predatory equity investments.

Strong indications of converting rent stabilized units to market rate: this portfolio saw 70% decline in rent stabilized units between 2007 and 2016.

Strong indications of construction-as-harassment: 25% of buildings in this portfolio are one standard deviation higher than the mean level of construction complaints per building in the city.

Around 40% of buildings received a loan from a bank identified by the Public Advocate as supporting predatory equity (city baseline: 2%)

70% decline in rent stabilized units (2007-2016)

One building on Street Easy list of properties advertised using coded language for predatory equity investments